additional net investment income tax 2021

This 38 surcharge Net Investment Income Tax is certainly more significant than the 09 Additional Medicare Tax both apply to thresholds over 250K married filing jointly and may be what the original poster was asking about. Since the 2021 tax brackets have changed compared with 2020.

Dividend Tax Rates In 2021 And 2022 The Motley Fool

But youll only owe it on the 30000 of investment income you havesince its less than your MAGI overage.

. April 28 2021 The 38 Net Investment Income Tax. Your additional tax would be 1140 038 x 30000. Rachel Blakely-Gray Jul 15 2021.

Net Investment Income Tax. For additional information refer to Publication 505 Tax Withholding and Estimated Tax Estimated Taxes and Am I Required to Make Estimated Tax Payments. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year.

The Net Investment Income Tax is separate from the Additional Medicare Tax which also went into effect on January 1 2013. This additional tax applies to. For income tax purposes T can reduce his taxable income by the FEIE amount for tax year 2021 the FEIE is US108700 meaning only US100000 will be subject to income tax.

As an investor you may owe an additional 38 tax called net investment income tax NIIT. Individuals with significant investment income may be subject to the Net Investment Income Tax NIIT. But youll only owe it if you have investment income and your modified adjusted gross income MAGI goes over a certain amount.

1 - The 38 tax is in addition to the tax rates for high income individuals. Related Question for How Do. Undistributed net investment income or the amount of adjusted gross income that exceeds the highest tax bracket of 13050 for 2021 and 13450 for 2022.

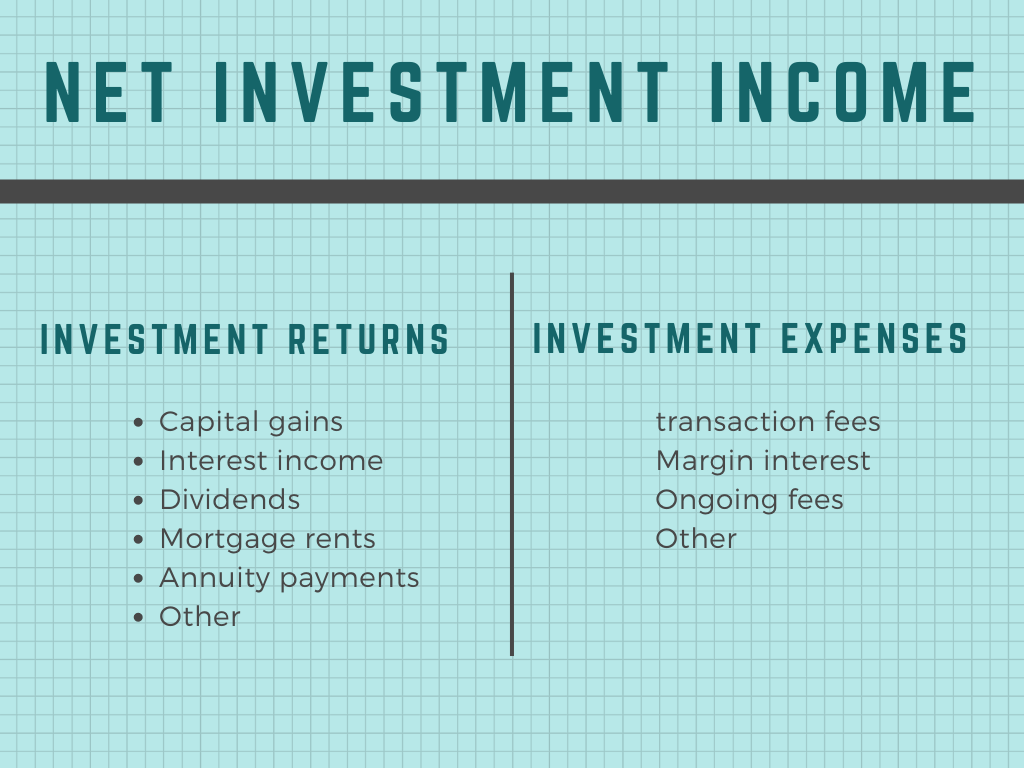

It applies to taxpayers above a certain modified adjusted gross income MAGI threshold who have unearned income including investment income such as. In general net investment income for purpose of this tax includes but isnt limited to. For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income.

However in determining his self-employment tax T cannot use the FEIE amount to reduce his self-employment income. The net investment income tax is an additional 38 tax on net investment income which generally includes i capital gain interest dividends certain annuities royalties and certain rents unless derived from a business activity in which the taxpayer materially participates. Alternative minimum tax AMT 2021 Exemption 2021 Phaseout MFJ SS 114600 10472001505600 S HH 73600 523600818000 MFS 57300 523600752800 Estates and Trusts.

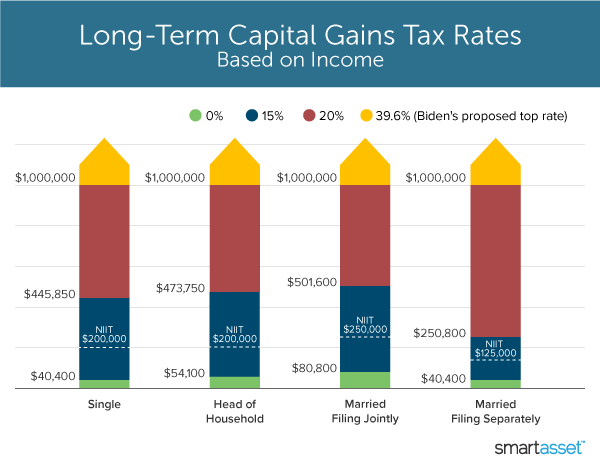

The Affordable Care Act of 2010 included a provision for a 38 net investment income tax also known as the Medicare surtax to fund Medicare expansion. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000. Those at the top brackets can have long-term capital gains and dividends taxed at 238 and other investment income taxed at 408.

What is the Net Investment Income Tax Rate. Recall that as an S corporation owner you are both employee and investor. Some high earners are subject to an additional 38 net investment income tax on some investments.

Ii income and gains from a business activity in which the taxpayer does not. Youre responsible for paying capital gains tax. And depending on how much money you make annually you may also be responsible for net investment income tax.

To help fund the Affordable Care Act Obamacare an additional Medicare surtax is tacked on to your net investment income. Investments includes portfolio income items such as interest dividends and short-term and long-term capital gains. Your net investment income is less than your MAGI overage.

However if the taxpayer is also subject to the net investment income tax there is an additional 38 tax imposed on those same capital. Royalties rental income and business income from activities that are treated as passive are also subject to the surtax. Net Investment Income Tax 38 Medicare Surtax 2021-12-17 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of individuals estates and trusts that exceed statutory threshold amounts.

Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold. Assume his net earnings from self-employment are US208700. 2 - There is an additional 09 Medicare tax on wages and self-employment income over the threshold amounts.

You may be subject to both taxes but not on the same type of income. Youll owe the 38 tax. The 38 Tax You May Need to Worry About.

Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income Medicare contribution tax more commonly referred to as the net investment income tax NIIT. Is there an extra tax penalty for net income over 250000. For additional information on the NIIT see Topic No.

Updated for Tax Year 2021 January 21 2022 0505 PM. According to an April 28 2021 Congressional Research Service Report the Joint Committee on Taxation estimates that the net investment income tax will raise approximately 275 billion of revenue in 2021 and that the majority of the tax is paid by higher-income households see Congressional Research Service The 38 Net Investment Income Tax. The statutory authority for the tax is.

You wont know for sure until you fill out Form 8960 to calculate your total net investment income. If your Modified Adjusted Gross Income exceeds 200000 or 250000 if youre married and filing jointly you may be subject to the NIIT. The 09 percent Additional Medicare Tax applies to individuals wages compensation and self-employment income over certain thresholds but it does.

When you trigger the high-income threshold for the Medicare surtax then you could pay 38 29 Medicare plus 09 surtax on some portions of your income. If you profit from your investments this ones for you. If you earn income from any of your investments this year you may have to pay the net investment income tax in addition to the regular income taxes you owe.

NIIT imposes a 38 surtax on income from investments.

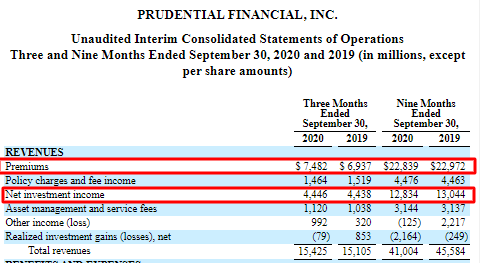

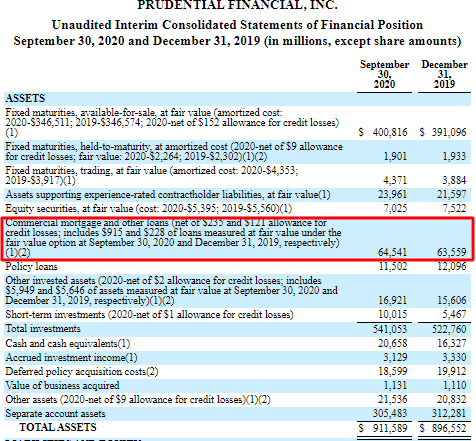

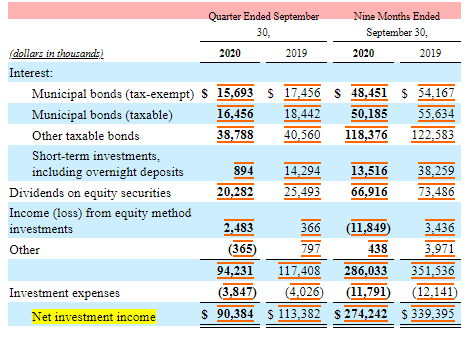

Why Net Investment Income Is Significant For Many Financial Companies

8960 Net Investment Income Tax 8960 K1 Schedulec Schedulee Schedulef

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Income Tax Brackets For 2022 Are Set

Avoiding The 3 8 Net Investment Income Tax Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Capital Gains Definition 2021 Tax Rates And Examples

What S In Biden S Capital Gains Tax Plan Smartasset

Tfsa Guide 2021 Investing Financial Advice Tax Free Savings

Income Tax Brackets For 2022 Are Set

Why Net Investment Income Is Significant For Many Financial Companies

/GettyImages-936538294-5135a50424a1482f87af9b4078b03aba.jpg)

Net Investment Income Nii Definition

Free Retirement Planning Resources Tenon Financial In 2021 Retirement Planning Retirement Free

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Create Welath Now In 2021 Wealth Creation Systematic Investment Plan Wealth

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

Why Net Investment Income Is Significant For Many Financial Companies

Why Net Investment Income Is Significant For Many Financial Companies